If you’re lucky enough to have won any of the tier prizes of the US Powerball, congratulations! Claiming your prize is easy and usually quite fast, but will also depend on how much you’ve won and how/where you’ve played. Let’s take a quick look at our lotto guide on how you can claim your US Powerball lottery prize and what you need to do so.

Contents

- What is the Prize Tiers for the US Powerball?

- 7 Easy Steps in Claiming Your Powerball Prize

- How and Where to Claim Your Powerball Prize

- Lottery Offices by State for Claiming Powerball Prizes

- How Long Can You Wait Before Claiming a Powerball Prize?

- Will You Have to Pay Tax on Your Powerball Prize?

- Final Thoughts

- FAQs

What is the Prize Tiers for the US Powerball?

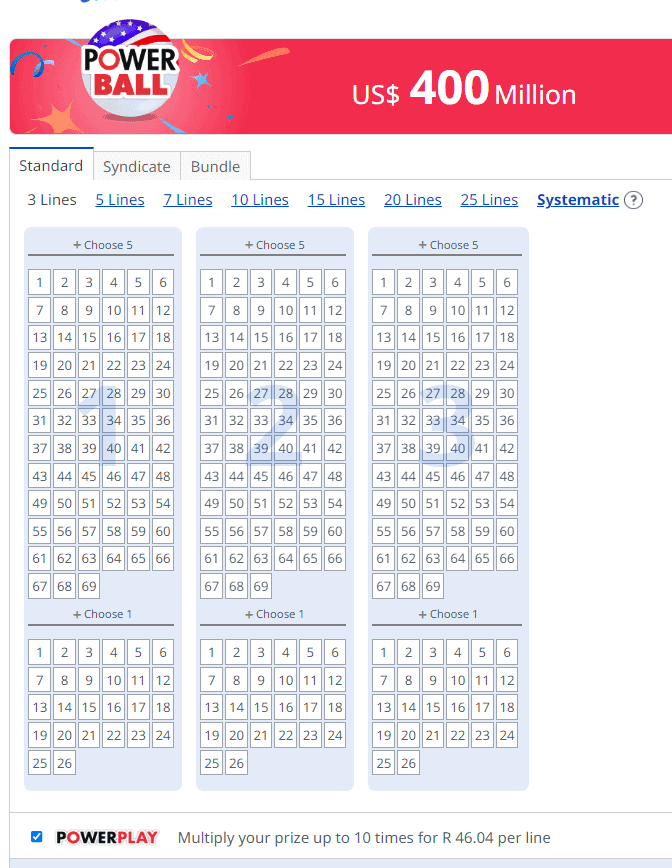

If you’ve matched any of the following number combinations, this is what you can expect to win. As you can see, there are several prize tiers, making it easier for you to win even if you don’t hit the jackpot. Each tier prize also depends on how many Power Plays you’ve included in your ticket.

Source: theLotter

Here is the prize structure for the US Powerball:

| Matching Numbers | Prize | Power Play X2 | Power Play X3 | Power Play X4 | Power Play X5 | Power Play X10 |

|---|---|---|---|---|---|---|

| 5 Numbers + Powerball | Grand Prize | Grand Prize | Grand Prize | Grand Prize | Grand Prize | Grand Prize |

| 5 Numbers | $2 Million | $1 Million | $1 Million | $1 Million | $1 Million | $1 Million |

| 4 Numbers + Powerball | $50 000 | $100 000 | $150 000 | $200 000 | $250 000 | $500 000 |

| 4 Numbers | $100 | $200 | $300 | $400 | $500 | $1 000 |

| 3 Numbers + Powerball | $100 | $200 | $300 | $400 | $500 | $1 000 |

| 3 Numbers | $7 | $14 | $21 | $28 | $35 | $70 |

| 2 Numbers + Powerball | $7 | $14 | $21 | $28 | $35 | $70 |

| 1 Number + Powerball | $4 | $8 | $12 | $16 | $20 | $40 |

| Only Powerball | $4 | $8 | $12 | $16 | $20 | $40 |

7 Easy Steps in Claiming Your Powerball Prize

Step #1: Double Check Your Ticket and Claim Ownership

The first step to claiming a US Powerball prize is to diligently check your ticket and ensure that it is signed. After purchasing a Powerball ticket, it is crucial to review it carefully, confirming that the numbers selected match the numbers drawn in the official Powerball drawing.

Double-checking your ticket helps to avoid any potential errors or oversights. Additionally, signing the back of your ticket serves as a vital security measure, as it establishes ownership and prevents anyone else from claiming your prize in the event of loss or theft. By taking this simple but crucial step, you safeguard your chances of successfully claiming your well-deserved Powerball prize.

Step #2: Decide on How You Want Your Prize Paid Out

If you’ve won a small tier prize, it’s likely that you will want the entire amount paid in one lump sum. But if you’ve hit one of the larger tiers, you might want to consider having your prize money paid out in installments.

Opting for a lump sum payment means you will receive the full amount immediately, albeit with a slightly reduced value due to taxes. This option provides immediate access to a significant sum of money, allowing you to make large purchases or investments right away.

On the other hand, choosing to receive your prize in installments offers a more structured approach, as you will receive a portion of the total amount annually over a specific period, (typically 29 years). This option can provide a steady income stream and ensure financial security in the long term. Ultimately the decision is yours!

Step #3: Claiming Your Prize

The claiming process for a US Powerball prize differs depending on whether you played online or physically purchased the ticket. The size of your prize also matters:

- Online: For online players, the process typically involves automatic notification and deposit of the winnings into your online account. If you win a smaller prize, it may be credited directly to your account, ready for withdrawal or future ticket purchases. In the case of larger prizes, you will need to follow specific procedures to claim the winnings, such as completing a claims form and providing your identification proof.

- In store purchases: For individuals who physically bought the ticket at an authorized retailer, the claiming process involves a few additional steps. Assuming you’ve already signed your ticket to establish ownership, and carefully checked the numbers against the official draw results, it’s now time to claim your prize.

- Small vs large prizes: Smaller prizes can usually be claimed directly from the retailer where the ticket was purchased. They will validate the ticket and provide you with the winnings. But for larger prizes it’s necessary to visit a state lottery office to claim your prize in person. You will need to fill out a claims form, present the signed ticket, and provide identification documents to verify your identity and ownership of the winning ticket. The state lottery office will guide you through the necessary procedures to receive your prize once you’ve contacted them within your state.

Step #4: Be Discreet During the Validation Process

During the validation process (meeting with the state lottery officials) of claiming a US Powerball prize, it is essential to exercise discretion and maintain confidentiality. Whether you played online or purchased a physical ticket, it is advisable to keep the news of your win to yourself and a trusted circle of individuals. Broadcasting your win publicly can attract unwanted attention, potentially putting your safety and security at risk.

It’s also a good idea to consult a financial advisor or attorney who specializes in managing large sums of money before making any major decisions. Additionally, following the guidelines provided by the lottery officials regarding publicity and media appearances can help protect your privacy and ensure a smooth validation process. By remaining discreet throughout the validation process, you can safeguard your personal well-being and maintain control over your newfound wealth.

Step #5: Get Your Prize!

Now that all the paperwork is done, you can finally receive your money and witness it reflecting on your bank balance! After successfully claiming your US Powerball prize, the next step involves the actual transfer of funds into your designated bank account.

This is an exciting moment! Depending on your chosen payout option, whether it’s a lump sum or installments, the funds will be paid to account accordingly.

Seeing the substantial sum of money arrive in your bank account is both thrilling and gratifying. Starting this new chapter of your life requires lots of wise planning. Be sure to not spend it all at once, and also make sure you put most of your winnings away into an interest-generating savings account or investment portfolio.

Step #6: Consult a Wealth-Management Professional

Winning a significant amount of money can bring about a range of financial challenges that require expert guidance. A wealth-management professional has the knowledge and experience to help you navigate through tax complications and help you with the managing and growing of your newfound wealth. They can also assist in developing a comprehensive financial plan tailored to your specific goals and circumstances.

This not only helps protect your wealth and ensure its longevity, but a professional can also provide insights into risk management, estate planning, and asset protection strategies. They can help you to establish a sustainable financial framework that allows you to meet both short-term and long-term goals, while safeguarding your wealth for future generations.

Step #7: Plan Your Spending

When it comes to spending your lottery winnings, it is crucial to exercise caution and plan for the long term. Past lottery winners will tell you about common mistakes that include impulsive spending, extravagant purchases, and failing to consider the financial implications of your choices.

Instead, focus on creating a sustainable financial plan that includes budgeting, investing wisely, and seeking professional advice. Prioritize debt management, establish an emergency fund, and allocate funds for future goals such as retirement or education.

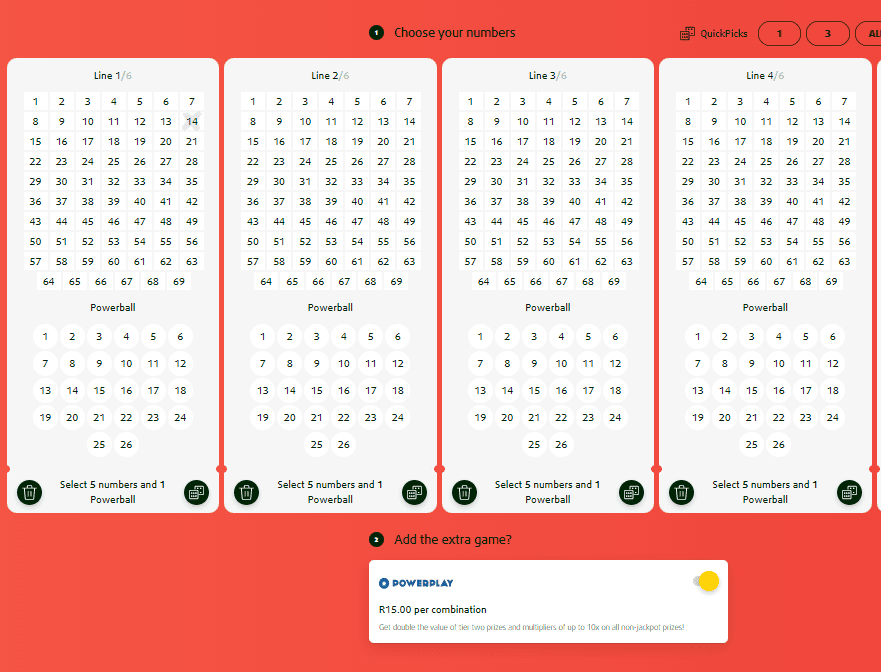

Source: Lottoland

How and Where to Claim Your Powerball Prize

Claiming Powerball prizes can vary depending on the country you’re in. Here’s a brief overview of the rules for claiming these four categories of Powerball prizes:

| Prize amount | Guidelines |

|---|---|

| Prizes under $600 | Can generally be claimed at authorized retailers or through mail-in claims. |

| Prizes over $600 | Require the winners to complete a claim form and submit it to the state lottery office. Valid identification and the signed winning ticket are typically required. |

| Jackpot prizes | Winners must contact the state lottery office and follow specific instructions to claim the substantial prize. It often includes extensive verification procedures and financial advice. |

| Online players who use lottery agents or international lottery sites | Can vary based on the jurisdiction. It’s important to review the terms and conditions of the specific website or agent used for playing and winning. Some sites may provide assistance in claiming prizes, while others may require winners to personally claim their prizes according to the rules of the respective country or state. |

Lottery Offices by State for Claiming Powerball Prizes

When putting in a claim locally, in the US, here are contact details of each state’s relevant offices and contacts for claiming prizes.

| State District | Prize Over $600 | Jackpot Winnings |

|---|---|---|

| Arizona | Phoenix office, 4740 E. University Dr., Phoenix, AZ 85034

Tucson office, 2900 E. Broadway Blvd., Ste 190, Tucson, AZ 85716 |

Either office |

| Arkansas | Arkansas Scholarship Lottery Claim Center, 1st Floor, Union Plaza Building, 124 West Capitol Ave. Little Rock, AR 72201 | Same |

| California | Lottery District Office (nine locations – San Francisco, Sacramento, East Bay, Central Valley, Van Nuys, Inland Empire, Santa Fe Springs, Santa Ana, San Diego) | Same |

| Colorado | Pueblo Claims Center HQ, 25 N Main Street, Pueblo, CO 81003 | Denver Claim Center, 720 S Colorado Blvd, Suite 110A, Denver, CO 80246 |

| Connecticut |

|

Rocky Hill Headquarters, on 777 Brook St, Rocky Hill, CT 06067 |

| Delaware | Prizes of $600 – $5,000 can be claimed at any of the 3 Redemption Centers | Delaware Lottery Office, 1575 McKee Road, Suite 102 Dover, DE 19904 |

| Florida | Prizes of $600 – $250,000 can be claimed at any Florida Lottery District Office (Tampa, Orlando, Fort Myers, West Palm Beach, Miami, Jacksonville, Gainesville, Tallahassee, Pensacola)

Also at Lotto Headquarters in Tallahassee |

Lottery Headquarters, 250 Marriott Drive, Tallahassee, FL 32301 |

| Georgia | Any of the 9 Headquarter locations in Atlanta or Lottery District Office | Headquarters in Atlanta, 250 Williams Street, Suite 3000, Atlanta, GA 30303 |

| Idaho | Lottery Headquarters, 1199 Shoreline Lane, Suite 100, Boise, ID 83702 | Same |

| Illinois | Claim Center (Chicago, Des Plaines, Rockford, Fairview Heights, Springfield) | Illinois Lottery Claims Department, Department of Revenue, Willard Ice Building, 101 West Jefferson Street Springfield, IL 62702 |

| Indiana | $600 – $49,999: Claimed at the Prize Payment Center in Evansville or Mishawaka or Indianapolis headquarters | Lottery Headquarters, Downtown Indianapolis, 1302 N. Meridian St., Indianapolis, IN 46202 |

| Iowa | Any of the 5 Iowa Lottery Offices (Cedar Rapids, Mason City, Storm Lake, Council Bluffs, Clive)

$250,000<: Claimed at Lottery Headquarters, located on 13001 University Ave, Clive IA |

Lottery Headquarters, located on 13001 University Ave, Clive IA |

| Kansas | Lottery Headquarters, 128 N Kansas Avenue Topeka, KS 66603 | Lottery Headquarters in Topeka |

| Kentucky |

|

$50,000<: Lotto Headquarters in Louisville |

| Louisiana | Any of the 6 Lottery Office locations – Baton Rouge, New Orleans, Lafayette, Alexandria, Monroe, Shreveport | $510,000<: Claimed at the Lottery Headquarters on 555 Laurel St. Baton Rouge, LA 70801 |

| Maine | Lottery Headquarters, 10 Water St, Hallowell, ME 04347 | Same |

| Maryland |

|

$25,000<: The Maryland Lottery Headquarters, Montgomery Park Business Center, 1800 Washington Boulevard, Suite 330, Baltimore, MD 21230 |

| Massachusetts | $601 – $49,999: Claimed from the Lottery Office (Braintree, New Bedford, Springfield, Woburn, Worcester, Boston) | Lottery Headquarters, 60 Columbian Street, Braintree, MA 02184 |

| Michigan | <$50,000: Claimed at any Lottery Regional Office (Lansing, Livonia, Detroit, Grand Rapids, Saginaw, Sterling Heights) | Lottery Headquarters, 101 E. Hillsdale in Lansing |

| Minnesota | Lottery Retailer or any of the Lottery Offices (Owatonna, Detroit, Virginia, Marshall, Roseville) | Lottery Headquarters, 2645 Long Lake Road, Roseville, MN 55113 |

| Mississippi | $600 – $99,999: Claimed at the Mississippi Lottery Headquarters in Flowood or by mail | Lottery Headquarters – Mississippi Lottery Corporation, 1080 River Oaks Drive, Bldg. B-100, Flowood, MS 39232 |

| Missouri | $600.01 – $35,000: Claimed at any of the Lottery Offices (Jefferson, Kansas, Springfield, St. Louis) | $35,000<: Lottery Headquarters, 1823 Southridge Drive, Jefferson City, MO |

| Montana | Lottery Headquarters, 525 North Montana Avenue, Helena Headquarters in Helena | Same |

| Nebraska | $501 – $19,999: Redeemed at any of the Claim Centers (Grand Island, Norfolk, North Platte, Omaha, Scottsbluff) | $20,000<: Lottery Office, located on Lincoln, 137 NW 17th Street |

| New Hampshire | Lottery Headquarters, 14 Integra Drive, Concord, NH 03301 | Same |

| New Jersey | Lottery Headquarters, Lawrence Park Complex, 1333 Brunswick Avenue Circle, Trenton, NJ 08648 | Same |

| New Mexico | $601 – $99,999: Claimed from the Lottery Headquarters, 4511 Osuna Rd. NE, Albuquerque, NM 87109 | $100,000<: Claimed from the Headquarters in Albuquerque |

| New York | Any of the 16 Claim Centers in Buffalo, Fishkill, Long Island, New York City, Schenectady, Syracuse, Jamaica, Yonkers, Saratoga, Farmington, Monticello, Hamburg, Nichols, Vernon, Batavia, North Islandia) | Same |

| North Carolina | $600 – $99,999: Lottery Headquarters, 2728 Capital Blvd, Suite 144 Raleigh, NC 27604 or any of the Regional Offices | $100,000<: Headquarters |

| North Dakota | Lottery Office, 1050 E Interstate Ave, Suite 200, Bismarck, ND | Same |

| Ohio | $600 – $5,000: Claimed from your Lottery Retailer, who will give you a ‘Pay to Bearer’ ticket. Retailer will also give you a list of bank-cashing locations where you can receive your prize | $5,000<: Any of these Regional Lottery Offices: Cleveland, Athens, Toledo, Dayton, Akron, Youngstown, Cincinnati, Lorain, Columbus |

| Oklahoma | $601 – $5,000: Lottery Office in Oklahoma City or any of the Claim Centers in Ardmore, Yukon, Woodward, Sand Springs, Bartlesville, Elk City, Guymon, Lawton, Muskogee, Norman, Pauls Valley, Perry | Lottery Headquarters, 3817 N. Santa Fe, Suite 175, 73118 |

| Oregon | <$50,000: Claimed at the Salem or Wilsonville office | $50,000<: Oregon Lottery, 500 Airport Rd SE, Salem, OR 97301. |

| Pennsylvania | <$2,500: Claimed from the Lottery Retailer.

$2,500<: Headquarters in Middletown or any of the Lottery Offices in Philadelphia, Wilkes-Barre, Harrisburg, Clearfield, Pittsburgh, Erie, Lehigh Valley |

Lottery Headquarters, 1200 Fulling Mill Road, Suite 1, Middletown, PA 17057 |

| Puerto Rico | <$25,000: Claimed at the Treasury Department or any of the Lottery Centers in Hato Rey, Ponce, Caguas, Mayagüez, Humacao and Arecibo | $25,000<: Lottery headquarters, Angel Ramos Foundation Building Suite 110, 383 Ave. Roosevelt, Hato Rey |

| Rhode Island | Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920 | Same |

| South Carolina | Columbia Claims Center, 1309 Assembly Street, Columbia, SC 29201 | Same |

| South Dakota | $101<: Claimed at any of the Lottery Offices in Rapid City, Sioux Falls, Pierre | Lottery Headquarters, 711 E. Wells Ave, Pierre, SD 57501 |

| Tennessee | $600 – $199,999: Claimed at any of the lottery district offices in Knoxville, Chattanooga, or Nashville, Memphis | $200,000<: Lottery Headquarters, One Century Place, 26 Century Blvd., Nashville, 37214 |

| Texas | $600 to $2.5 million: Claim Center or Lottery Commission in Austin Texas Lottery Commission, 611 E 6th St, Austin, TX 78701 | Same |

| U.S. Virgin Islands | $1,200<: Claimed at the Lottery Office in St. Thomas, Sunny Isle Shopping Center Lottery Office, or Frederiksted Ticket Sales Office | Same Offices in St. Thomas or Frederiksted |

| Vermont | $500 – $5,000: Claimed at People’s United Bank with a Claim Form, or at the Headquarters in Berlin, Vermont | $5,000<: Lottery Headquarters, 1311 US Route 302, Berlin, VT |

| Virginia | Customer Service Center in Richmond, Harrisonburg, Hampton, Farmville, Roanoke, Abingdon, or Woodbridge | Lottery Headquarters, 600 E. Main Street, Richmond, VA 23219 |

| Washington State | <$100,000: Any of the Lottery Offices in Everett, Federal Way, Spokane Valley, Vancouver, or Yakima | $100,000<: Claimed from the Lottery Headquarters, 814 4th Avenue East Olympia, WA 98506 |

| Washington D.C. | $601 – $5,000: Claimed from the Prize Center | $5,000<: Claimed at the Office of Lottery and Charitable Games Prize Center, Lobby Level, 2235 Shannon Place, S.E. Washington, D. C. 20020 |

| West Virginia | Lottery Headquarters in Charleston, 900 Pennsylvania Ave, Charleston, WV 25302 or at the Regional Office in Weirton, 100 Municipal Plaza, Suite 500, Weirton, WV 26062 | The same Lottery Headquarters in Charleston |

| Wisconsin | $600 – $500,000: Madison Office, Department of Revenue, 2135 Rimrock Road Madison, WI 53713 or Milwaukee Lottery Office, State Office Building 819 N. 6th Street, 4th Floor Service Counter, Milwaukee, WI 53203 | $501,000<: Claimed at the same Madison Lottery Office |

| Wyoming | Lottery Headquarters, 1620 Central Avenue, Suite 100, Cheyenne, WY | Same |

How Long Can You Wait Before Claiming a Powerball Prize?

Tickets for Powerball can expire, so you need to claim within a certain period of time. However, don’t expect your cash in your account immediately. Sometimes the claims process takes a bit of time. Your wait will depend on what state you’re in.

Here’s a reference guide for each state so you can take action before your ticket is no longer worth anything:

| State | Claim Period | Prize Sum Claimable by Mail |

|---|---|---|

| Arizona | 180 Days | Any Prize |

| Arkansas | 180 Days | Any Prize |

| California | 1 year for the jackpot

180 days for other prizes |

Any Prize |

| Colorado | 180 Days | Any Prize |

| Connecticut | 180 Days | Less than $50,000 |

| Delaware | 1 Year | Anything less than $600 |

| Florida | 180 Days | Anything less than $250,001 |

| Georgia | 180 Days | Any Prize |

| Idaho | 180 Days | Any Prize |

| Illinois | 1 Year | Anything less than $1,000,000 |

| Indiana | 180 Days | Any Prize |

| Iowa | 180 Days | Anything less than $250,001 |

| Kansas | 1 Year | Any Prize |

| Kentucky | 180 Days | Anything less than $50,000 |

| Louisiana | 180 Days | Anything less than $510,001 |

| Maine | 1 Year | Any Prize |

| Maryland | 182 Days | Any Prize |

| Massachusetts | 1 Year | Undisclosed |

| Michigan | 1 Year | Any Prize |

| Minnesota | 1 Year | Anything less than $50,001 |

| Mississippi | 180 Days | Any Prize |

| Missouri | 180 Days | Any Prize |

| Montana | 180 Days | Any Prize |

| Nebraska | 180 Days | Any Prize |

| New Hampshire | 1 Year | Any Prize |

| New Jersey | 1 Year | Any Prize |

| New Mexico | 90 Days | Anything less than $100,000 |

| New York | 1 Year | Any Prize |

| North Carolina | 180 Days | Anything less than $100,000 |

| North Dakota | 180 Days | Any Prize |

| Ohio | 180 Days | Undisclosed |

| Oklahoma | 180 Days | Any Prize |

| Oregon | 1 Year | Any Prize |

| Pennsylvania | 1 Year | Any Prize |

| Puerto Rico | 180 Days | Undisclosed |

| Rhode Island | 1 Year | Undisclosed |

| South Carolina | 180 Days | Anything more than $500 |

| South Dakota | 180 Days | Any prize |

| Tennessee | 180 Days | Anything less than $200,000 |

| Texas | 180 Days | Anything less than $2,500,001 |

| U.S. Virgin Islands | 6 Months | Any prize |

| Vermont | 1 Year | Any prize |

| Virginia | 180 Days | Any prize |

| Washington State | 180 Days | Any prize |

| Washington D.C. | 180 Days | Any prize |

| West Virginia | 180 Days | Any prize |

| Wisconsin | 180 Days | Anything less than $600,000 |

| Wyoming | 180 Days | Any prize |

Will You Have to Pay Tax on Your Powerball Prize?

As a US Powerball winner, your winnings do qualify for federal tax within the US. If you choose to be paid a lump sum of the jackpot amount, you will likely pay taxes on the total amount at the federal level. The federal tax rate for lottery winnings is currently set at a maximum of 37%.

It’s important to note that the actual amount of tax you owe can vary depending on factors such as your overall taxable income, filing status, and potential deductions or credits you may be eligible for. The 37% tax rate applies to the highest income bracket, and not all winners will fall into that bracket.

Also, when playing this lottery via online lottery sites such as theLotter, you also need to research tax laws. It’s best to consult a tax lawyer in the country you’re playing from. Depending on local laws, cash you receive from lottery agents could be taxable.

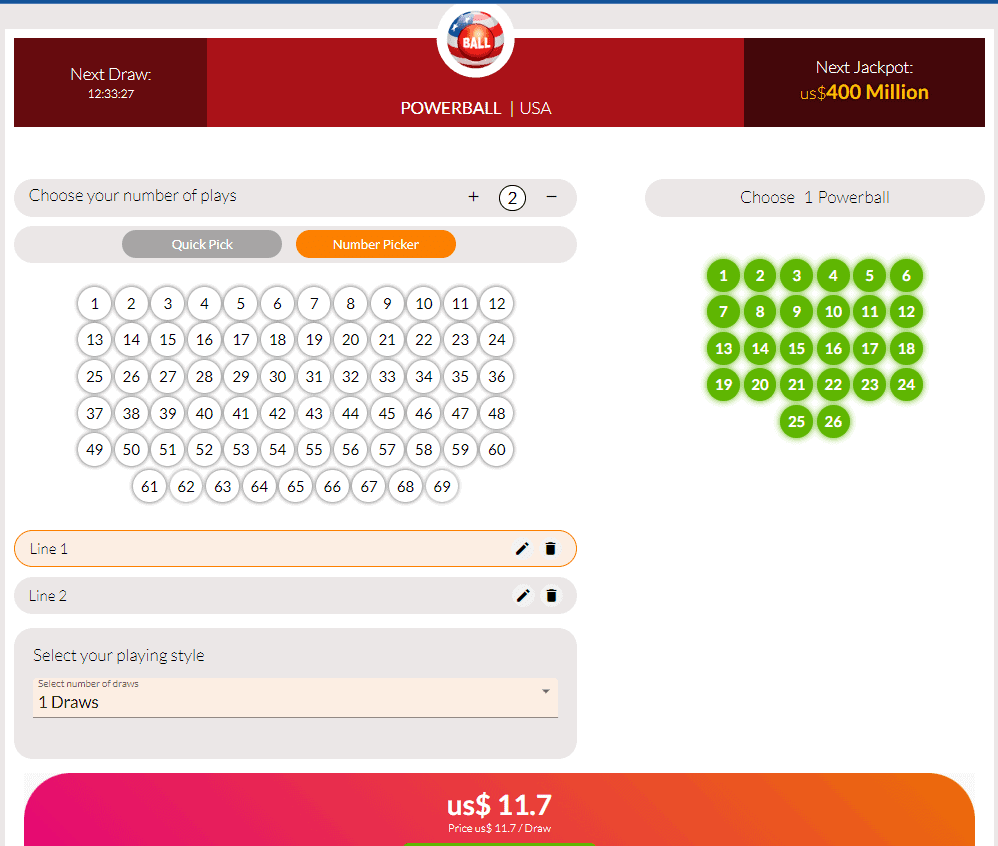

Source: WinTrillions

Final Thoughts

By making thoughtful decisions and thinking long-term, you can ensure that your lottery winnings have a lasting positive impact on your financial well-being. Winning feels great, and you want to ensure that feeling lasts as long as possible.

Enjoy your winnings!

FAQs

What is the US Powerball?

The US Powerball is a widely recognized and popular lottery game played in the United States. It is known for offering some of the largest and most substantial jackpots in the world.

Must I Be a US Citizen to Play the US Powerball?

You can play the US Powerball from anywhere in the world. Simply visit one of the many online lottery sites and purchase your ticket online to play!

When is the 10X Multiplier Applicable in the Powerball?

When the jackpot for that particular week is less than $150 million, the 10X multiplier is applicable and playable for all participants.

How is the US Powerball Grand Prize Determined?

The advertised Grand Prize estimate in the Powerball game is determined by several key elements, including game sales and the annuity calculation.

Game sales can be influenced by various factors, such as seasonal patterns or the availability of a significant jackpot. Generally, more tickets are sold for Saturday drawings compared to those held on Wednesdays.

The annuity calculation is another crucial aspect that affects the Grand Prize amount. It involves evaluating the cost of funding the annuity prize and takes into account interest rates associated with the securities purchased to support prize payments. Interestingly, when interest rates are higher, the advertised Grand Prize is also higher.

How Long Must I Wait for My Winnings to Be Paid Out?

In jurisdictions where Mega Millions and Powerball are accessible, prizes below $599 are commonly eligible for direct collection at a lottery retailer, contingent upon the retailer having adequate funds at their disposal to disburse the prize.

For prizes reaching a sum of $600 or higher, the protocols governing the collection of winnings may exhibit slight variations across different regions, but generally adhere to a similar framework. To obtain your winnings, it becomes imperative to authenticate your victorious ticket via the official state lottery entity and complete a requisite claim form. The process of ticket authentication can typically be conducted either by mail or through an in-person visit. This process may take longer to get your winnings compared to claiming from a local registered outlet.